The Lion's Den Vol. 3 - SaaS Businesses Are Harder to Measure Than You Think (Part I)

Real-life examples of how fungible and manipulatable "standard" SaaS KPIs are

I love SaaS businesses. One of my first “adult” jobs was selling Salesforce CRM licenses >15 years ago. I had to explain to customers that the server doesn’t need to be there, that the software will update itself, and that their data will be secure in the cloud and available on demand. Wasn’t an easy sell back then…

I’ve since advised and backed numerous SaaS companies and despite all the well known benefits of the business model I’ve come to realize that these businesses may seem simple to analyze, but are hard to truly understand. SaaS companies are data-rich and are easy to measure (David Sacks wrote a good post about it), but without deeply understanding how these metrics were compiled and reported you can easily reach the wrong conclusion.

In this 2-part post I won’t focus on what’s a good or bad LTV/CAC, etc., the internet is full of those benchmarks. Instead, I’ll walk through how different presentations of the same metric can show a vastly different picture. As usual, will keep it to a ~5 min. read - Let’s go!

Not All Revenue Streams Are Created Equal

To kick things off, let’s take a look at what is seemingly the most straightforward metric, revenue. Most SaaS companies are valued on a revenue (or ARR) multiple so it behooves them to show a top line number that is as high as possible. But even this simple metric can be played with:

Gross vs. Net Sales - Many SaaS companies utilize discounts to attract new customers or to compel them to sign multi-year agreements. I’ve seen many companies that present “Sales” or “Gross Sales” without clarifying the discount offset. When dealing with private companies, I have even seen companies classify discounts as S&M, which is a big no-no. Because customer and revenue growth can be artificially boosted by large discounts, getting the Net Sales figure is critical in order to (1) understand the importance of discounts to acquire new customers (2) calculate the REAL gross margin (3) anticipate churn.

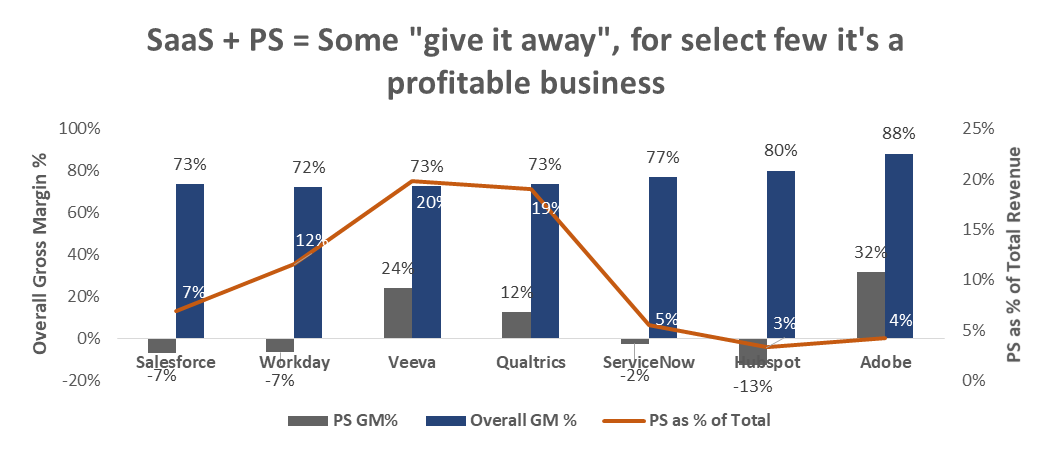

Subscription vs. Professional Services - Many SaaS companies pride themselves in being “hands free”, but in reality there’s often a professional service (“PS”) component, especially for companies serving large enterprise customers. PS is a less lucrative business with lower margin - to put that in context, in FY’22 Salesforce reported $24.6B of subscription revenue and $1.8B of PS revenue. The subscription segment had a ~79% gross margin, while the PS segment had a negative gross margin! Other SaaS companies showcase generally similar economics on PS, with very few actually generating healthy profits on PS.

Because the requirement to report segments begins when a segment is 10%+ of revenue, even public companies sometimes make an operational/accounting effort to blend PS in with the rest of the subscription revenue and avoid separate reporting.

Volume-based vs. Subscription - Volume-based revenue in SaaS is a big trend for many good reasons, but bundling subscription with other types of revenue can confuse investors that don’t read the fine print. Take Wix as an example (disclaimer: I’ve advised the company in the past, am friends with management and have a portfolio company in the space): Wix used to generate 90%+ of its revenues from subscriptions and, over time time, started diversifying its top line with:

Third-party apps (mostly G suite), for which it receives a small rev. share.

Other volume-based solutions, such as Wix Payments, for which it keeps a small % of every transaction.

While this evolution makes strategic sense (increasing ARPU, improving “stickiness”, etc.), these different streams of revenue are very different in profitability and value. Between 2017-2021, Wix’s revenue grew ~32% CAGR from $425M to $1.3B. Double clicking into that number shows that the high-margin subscription revenue grew only 25%/yr, while the lower margin “volume” business grew 75%/yr. Not surprisingly, gross margin dropped from ~84% in 2017 to ~62% in 2021. Wix has openly discussed its strategic decisions and operational metrics throughout the years (and as of ‘19 started reporting subscriptions and other revenues separately), but many companies, especially private ones, tend to blend GMV, rev. share and subscription revenue, providing an inaccurate representation of their revenue.

To truly understand a company’s top line it’s important to look into all revenue streams, understand the growth trend and margin in each and potentially value them separately.

Other P&L “Hidden Gems”

ARR (…or is it?) - ARR, or Annual Recurring Revenue, is a valuable metric because it gives investors confidence in a company’s revenue trajectory. But not all subscription revenue is ARR and companies often try to squeeze their top line metric into that definition when it really doesn’t apply. For example:

Re-occurring vs. recurring revenue - if customers have repeatedly come back, that’s great. But if they have no annual contractual obligation, it’s hard to rely on that revenue stream to recur when you expect it to. That uncertainty of cashflows, unless dispelled through many years of steady cohorts, may warrant a lower valuation multiple.

Monthly vs. annual subscriptions - Yes, ARR equals (MRR * 12), but if a company’s subscriptions are mostly monthly, using ARR doesn’t really work. Take SEMRush, for example. A terrific company, but with questionable metric reporting. SEMRush generates 78% of its revenues from monthly subscriptions and defines its ARR as:

….the daily revenue of all paid subscription agreements that are actively generating revenue as of the last day of the reporting period multiplied by 365. We include both monthly recurring paid subscriptions, which renew automatically unless cancelled, as well as the annual recurring paid subscriptions so long as we do not have any indication that a customer has cancelled or intends to cancel its subscription…

This ARR definition is…unique and I’ve not seen it elsewhere. From my point of view, using daily revenue, which can probably fluctuate quite a bit, is just not a good indication of a full year’s run-rate.

Customer Support/Success - Companies know investors prefer high gross margin businesses as they “leave enough room” for aggressive opex investments and can translate to high profit margins later on. As a result, companies will sometimes report customer support/success in OPEX instead of COGS, artificially increasing gross margin. This is a gray area that not all CFOs/auditors agree on with the main debate being whether that function actually sells something or just supports the delivery of the product/revenue. GoDaddy is an interesting example: It is known for having a very sales-oriented customer care that generated 11% of 2021 bookings. As a result, it classifies its $300M+/yr of “customer care” in OPEX (unlike peers such as Squarespace and Wix) and reports a 64% gross margin. Had it classified customer care similar to its peers, that gross margin would be 56% and by far the lowest in its sector.

Capitalized Software Costs - Companies can capitalize vs. expense certain R&D costs (i.e. incur the cash expenditure on the cashflow statement, but recognize the expense gradually over time on the P&L). This is specifically meant for internal-use software or software that is not ready to sell, but the definitions are a bit fungible. Capitalizing R&D lowers a company’s ongoing OPEX and increases their EBITDA. Because this line item sits under “cash flows from investing” it might escape the radar of investors that estimate free cash flow as Cashflow from Operations. As a rule of thumb, if capitalized software costs are close to or higher than the ongoing R&D costs, it should raise a flag (either the company is very enthusiastic about internal tools or it’s not presenting R&D spend appropriately to investors).

C'est tout for part I and we’ve barely crossed through the first 2-3 line items of a standard P&L. Part II coming soon with some juicy color on investors’ favorite place to dig - unit economics: churn, net dollar retention, LTV, CAC, etc. A LOT to unpack there.

Onwards!

Omer

@omerutah14

Very interesting and educational. Thanks man!

Very interesting and educational. Thanks man!